To qualify for a 392 Charger, you’ll need a credit score of at least 670. Having a good credit score is crucial when applying for financing a car.

A credit score reflects your financial reliability and determines the interest rate you’re eligible for when getting auto financing. Higher credit scores can also lead to lower monthly payments and overall savings on the loan. Before applying for a 392 Charger or any car loan, it’s important to check your credit score and take steps to improve it if necessary.

Understanding your credit score can help you make informed decisions and secure better loan terms.

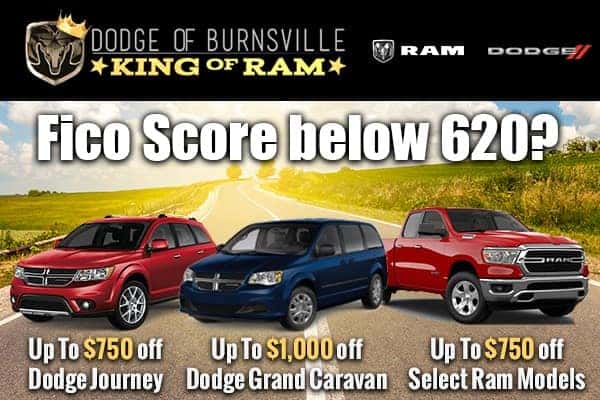

Credit: www.dodgeofburnsville.com

Understanding Credit Scores For Auto Financing

Before you set your sights on that sleek 392 Charger, it’s crucial to understand how your credit score impacts your ability to secure auto financing. Knowledge of this crucial aspect can help you navigate the process more effectively and potentially save you money in the long run. So, let’s delve into the nitty-gritty of credit scores and their role in auto financing.

Importance Of Credit Scores In Car Loans

Your credit score plays a pivotal role in determining your eligibility for an auto loan. Lenders assess your credit score to gauge the level of risk involved in extending credit to you. A higher credit score generally signals a lower risk, making you more attractive to lenders. On the other hand, a lower credit score may result in higher interest rates or even denial of the loan altogether.

How Credit Scores Affect Loan Terms And Interest Rates

The impact of your credit score on auto loan terms and interest rates cannot be overstated. A higher credit score can secure you more favorable loan terms, including lower interest rates and better repayment options. Conversely, a lower credit score may lead to less favorable terms and higher interest rates, potentially costing you more over the life of the loan.

Common Credit Score Benchmarks For Auto Financing

When it comes to auto financing, certain credit score benchmarks are commonly used by lenders to categorize applicants. While specific requirements may vary between lenders, a general guideline can be observed. For example, a credit score above 700 is often considered excellent and can lead to the most favorable loan terms. Scores between 650 and 700 are generally seen as good, while scores below 650 may encounter challenges in securing favorable financing.

Credit Score For A 392 Charger Explained

When it comes to financing a powerful and stylish vehicle like the 392 Charger, having a good credit score is crucial. Understanding the credit score requirements for a 392 Charger can help you plan and prepare for your purchase. In this guide, we will break down the ideal credit score range for 392 Charger models, the factors that influence credit score requirements, and compare the credit score demands for new and used 392 Chargers.

Ideal Credit Score Range For Dodge Charger 392 Models

The ideal credit score range for purchasing a Dodge Charger 392 can vary depending on the lender and individual circumstances. However, generally, a credit score of 700 or higher is considered good for securing favorable financing options for a new 392 Charger. A credit score in the 650-699 range may still qualify for financing but could result in higher interest rates and less favorable terms. For used 392 Chargers, lenders may be more flexible, with credit scores in the 600-650 range being acceptable.

Factors Influencing Credit Score Requirements

Several factors can influence the credit score requirements for purchasing a 392 Charger. Steady income, low debt-to-income ratio, and a clean credit history are some of the key factors that lenders consider when evaluating an individual’s creditworthiness. Additionally, a larger down payment can help offset a lower credit score and improve the chances of securing financing for a 392 Charger. Understanding these factors and taking steps to improve them can work in your favor when applying for a car loan.

Comparing Credit Score Demands For New Vs. Used 392 Chargers

| Credit Score Range | New 392 Charger | Used 392 Charger |

|---|---|---|

| 700 and above | Favorable financing options | Potential for competitive financing |

| 650-699 | May qualify with higher interest rates | Acceptable credit score for financing |

| 600-650 | Challenging to secure favorable terms | Possible financing options with higher rates |

Overall, while a higher credit score is advantageous for both new and used 392 Chargers, lenders may be more lenient with credit requirements for pre-owned vehicles.

Financing A 392 Charger With Good Credit

When it comes to financing a powerful, high-performance vehicle like the 392 Charger, having a good credit score can significantly impact your ability to secure favorable loan terms. With a solid credit history, borrowers can enjoy lower interest rates, better loan terms, and higher approval chances. This article delves into the advantages of a high credit score when financing, examples of loan terms for borrowers with excellent credit, and tips to maintain or improve credit before applying.

Advantages Of A High Credit Score When Financing

Having excellent credit when financing a 392 Charger offers multiple advantages, including:

- Access to lower interest rates, potentially leading to significant savings over the life of the loan.

- Increased borrowing power, allowing for larger loan amounts and favorable repayment terms.

- Higher chances of approval, as lenders view good credit as a sign of financial responsibility.

- Potential eligibility for exclusive financing offers and incentives from lenders.

Examples Of Loan Terms For Borrowers With Excellent Credit

Borrowers with excellent credit seeking to finance a 392 Charger may be presented with enticing loan terms, such as:

| Loan Term | Interest Rate | Repayment Period |

|---|---|---|

| $40,000 | 3.5% | 60 months |

| $50,000 | 3.0% | 72 months |

| $60,000 | 2.75% | 84 months |

Tips To Maintain Or Improve Credit Before Applying

Prior to applying for financing for a 392 Charger, consider the following tips to maintain or improve your credit:

- Regularly monitor your credit report for errors and address any inaccuracies promptly.

- Make timely payments on existing debts and keep credit card balances low.

- Avoid opening multiple new credit accounts in a short period, as this can negatively impact your credit score.

- Establish a solid payment history, showcasing responsible credit management to lenders.

- Utilize credit responsibly and aim to maintain a healthy credit utilization ratio.

Subprime Loans And The 392 Charger

When it comes to financing a powerful, stylish vehicle like the 392 Charger with a lower credit score, understanding the implications of subprime loans is essential. This article will explore the challenges of securing financing for a 392 Charger with a subprime credit score, the risks and considerations associated with subprime loans, and strategies to navigate the process successfully.

Understanding Subprime Credit And Its Impact On Financing

Subprime credit refers to a credit score that is below the prime threshold, typically around 620. Individuals with subprime credit often face challenges when seeking financing for a vehicle like the 392 Charger, as lenders consider them higher risk borrowers. Consequently, they may be subject to higher interest rates and less favorable loan terms.

Risks And Considerations With Subprime Loans For A 392 Charger

- Higher interest rates: Subprime borrowers may encounter significantly higher interest rates when securing a loan for a 392 Charger, leading to higher overall loan costs.

- Increased likelihood of loan denial: Lenders may be more cautious when considering subprime applicants, resulting in a higher likelihood of loan denial or stricter conditions for approval.

- Long-term financial impact: Subprime loans can have long-term financial implications, affecting the borrower’s credit and financial stability if not managed effectively.

Strategies To Secure A Loan With A Lower Credit Score

- Improve credit score: Taking steps to improve one’s credit score before applying for a loan, such as paying off outstanding debts and managing credit responsibly, can enhance the likelihood of approval and more favorable loan terms.

- Seek pre-approval: Pre-approval can provide a clear understanding of the loan amount and terms a borrower qualifies for, helping to streamline the car buying process and potentially secure more favorable financing.

- Consider a co-signer: A co-signer with a stronger credit profile can bolster the likelihood of loan approval and may lead to more advantageous terms.

Enhancing Creditworthiness For Your Dream Car

Are you eyeing that sleek 392 Charger but concerned about your credit score? A good credit score is crucial when purchasing a high-value item like a car. Enhancing your creditworthiness is the first step to turning your dream into a reality. In this post, we’ll explore the steps to improve your credit for a future purchase, the time it takes to enhance credit scores, and resources and services to monitor and increase credit scores. Let’s get you closer to that Charger!

Steps To Improve Credit For A Future Purchase

Improving your credit score is a gradual process that requires patience and dedication. Here are some actionable steps to boost your creditworthiness:

- Regularly check your credit report for errors, and promptly dispute any inaccuracies.

- Pay your bills on time to establish a positive payment history.

- Reduce your credit card balances to lower your credit utilization ratio. Aim to keep your balances below 30% of your credit limit.

- Avoid opening new lines of credit, as this can lower the average age of your accounts.

How Long It Takes To Improve Credit Scores

The time it takes to improve your credit scores depends on various factors, including the severity of past credit issues and your dedication to implementing good financial habits. Generally, significant improvements can be seen within six months to a year, but restoring a high credit score can take several years of responsible financial management.

Resources And Services To Monitor And Increase Credit Scores

Fortunately, there are numerous resources and services available to help individuals monitor and improve their credit scores. Some helpful options include:

| Resource/Service | Description |

|---|---|

| Credit monitoring services | These services provide regular updates and alerts regarding changes in your credit report, allowing you to stay informed and address any issues promptly. |

| Financial counseling organizations | Seek guidance from reputable financial counseling organizations to receive personalized advice on improving your credit and managing your finances effectively. |

| Credit score simulators | Use online tools and simulators to understand how specific financial actions, such as paying off a debt or closing a credit card account, can impact your credit score. |

Frequently Asked Questions For Credit Score To Get A 392 Charger

What Credit Score Is Needed To Finance A 392 Charger?

To finance a 392 Charger, you’ll typically need a credit score of 680 or higher. However, a higher credit score may result in better financing terms and lower interest rates.

How To Improve My Credit Score To Get A 392 Charger?

To improve your credit score for a 392 Charger, focus on paying bills on time, reducing credit card balances, and avoiding new credit inquiries. Additionally, regularly check your credit report for errors.

Can I Get A 392 Charger With A Low Credit Score?

It’s possible to get a 392 Charger with a low credit score, but you may face higher interest rates and less favorable financing terms. Consider improving your credit score before applying for financing.

Conclusion

Achieving a good credit score is essential when considering to purchase a 392 Charger. By consistently making on-time payments and maintaining a low credit utilization rate, you can improve your creditworthiness. Start building your credit score early, manage your debts responsibly, and regularly monitor your credit report to ensure your eligibility for financing a 392 Charger.